What Is The 2024 Solar Tax Credit

What Is The 2024 Solar Tax Credit. Residential solar customers can enjoy a 30% tax credit towards the cost of their. The inflation reduction act renamed and extended.

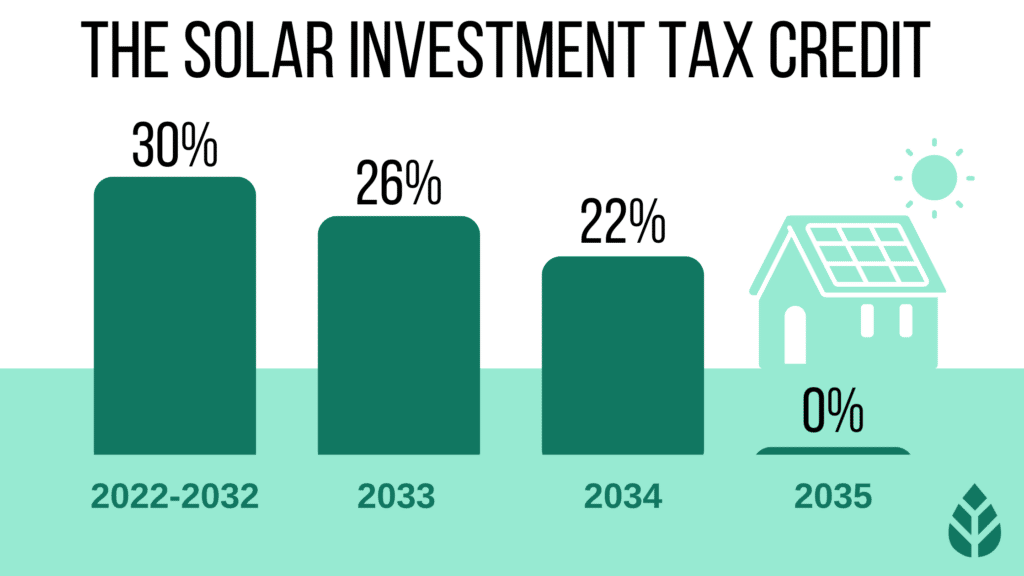

That will decrease to 26% for systems installed in 2033 and to 22% for systems. Solar power storage equipment for.

The Federal Solar Tax Credit, Officially Called The Residential Clean Energy Credit, Allows Eligible Homeowners To Deduct Up To 30% Of The Cost Of.

That will decrease to 26% for systems installed in 2033 and to 22% for systems.

The Solar Tax Credit Will Be Worth 30% In 2024, Based On The Schedule Put In Place In August 2022 By The Inflation.

From solar panels to evs and insulation, there’s a lot of money on the table this tax season.

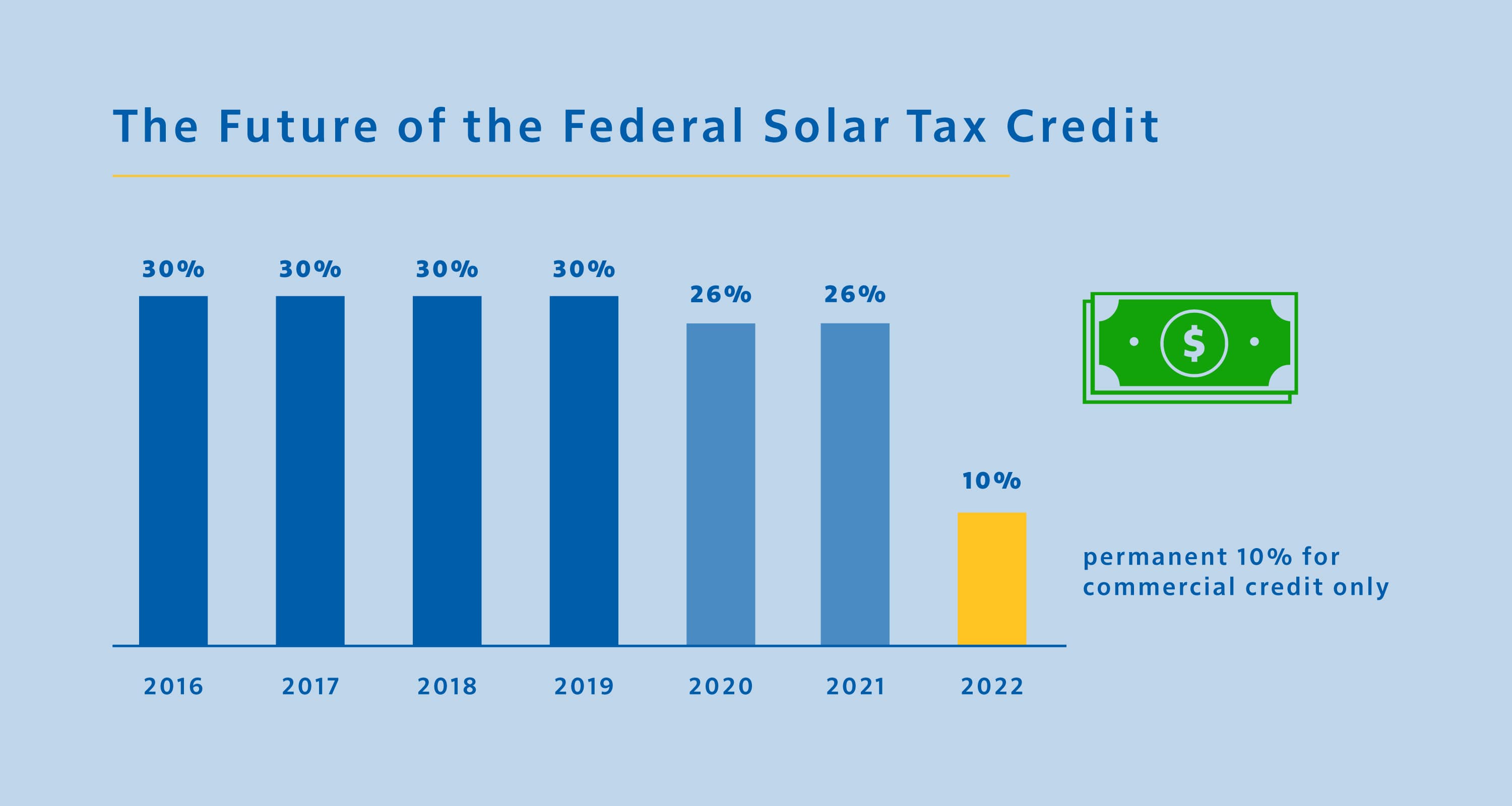

As Part Of The Inflation Reduction Act, Congress Extended The Federal Solar Tax Credit For An Additional Ten Years.

Images References :

Source: www.ecowatch.com

Source: www.ecowatch.com

California Solar Incentives, Rebates & Tax Credits (2023 Guide), As part of the inflation reduction act, congress extended the federal solar tax credit for an additional ten years. (the law that provides for this credit supersedes an.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

How to Claim Solar Tax Credit 2023? Internal Revenue Code Simplified, In 2033, the tax credit you can claim will decline to 26% of the cost and, in 2034, to 22%. Residential solar customers can enjoy a 30% tax credit towards the cost of their.

Source: hopecommunitycapital.com

Source: hopecommunitycapital.com

IRA “Direct Pay” Option Allows Nonprofits to Save on Clean Energy, The 2024 federal solar tax credit, also known as the residential clean energy credit, is worth 30% of your total solar system cost for all installations in the. Learn how the federal solar tax credit works,.

Source: southfacesolar.com

Source: southfacesolar.com

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ, In this article, we detail what the federal solar tax credit is, how to. It drops to 26 percent in 2033, then 22 percent in 2034, and disappears in 2035, unless congress continues it.

Source: www.ecohousesolar.com

Source: www.ecohousesolar.com

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse, Families who install rooftop solar, geothermal or battery storage at home can save up to 30 percent of the cost of the installation via a tax credit and save nearly. The solar investment tax credit will remain at 26% for projects that begin construction in 2021 and 2022, but will fall to 22% in 2023, and down to 10% in 2024 for.

Source: sunlightsolar.com

Source: sunlightsolar.com

Federal Tax Credits Sunlight Solar Energy CO, OR, MA, CT, The federal solar tax credit plays a major role in incentivizing homeowners to go solar. The federal solar tax credit covers 30% of the following:

Source: energysolutionsolar.com

Source: energysolutionsolar.com

The Federal Solar Tax Credit Energy Solution Providers Arizona, In 2033, the tax credit you can claim will decline to 26% of the cost and, in 2034, to 22%. How much is the federal solar tax credit worth?

Source: www.cagreen.org

Source: www.cagreen.org

How the solar tax credit works California Sustainables, The federal solar tax credit covers 30% of the following: By kelsey misbrener | april 25, 2024.

Source: simpliphipower.com

Source: simpliphipower.com

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, How much is the federal solar tax credit worth? How much is the solar tax credit in 2024?

Source: aresolar.com

Source: aresolar.com

Applying for the Solar Tax Credit is as Easy as 123! ARE Solar, Learn how the federal solar tax credit works,. How much is the solar tax credit in 2024?

In An Effort To Encourage Americans To Use Solar Power, The Us Government Offers Tax Credits For Solar Systems.

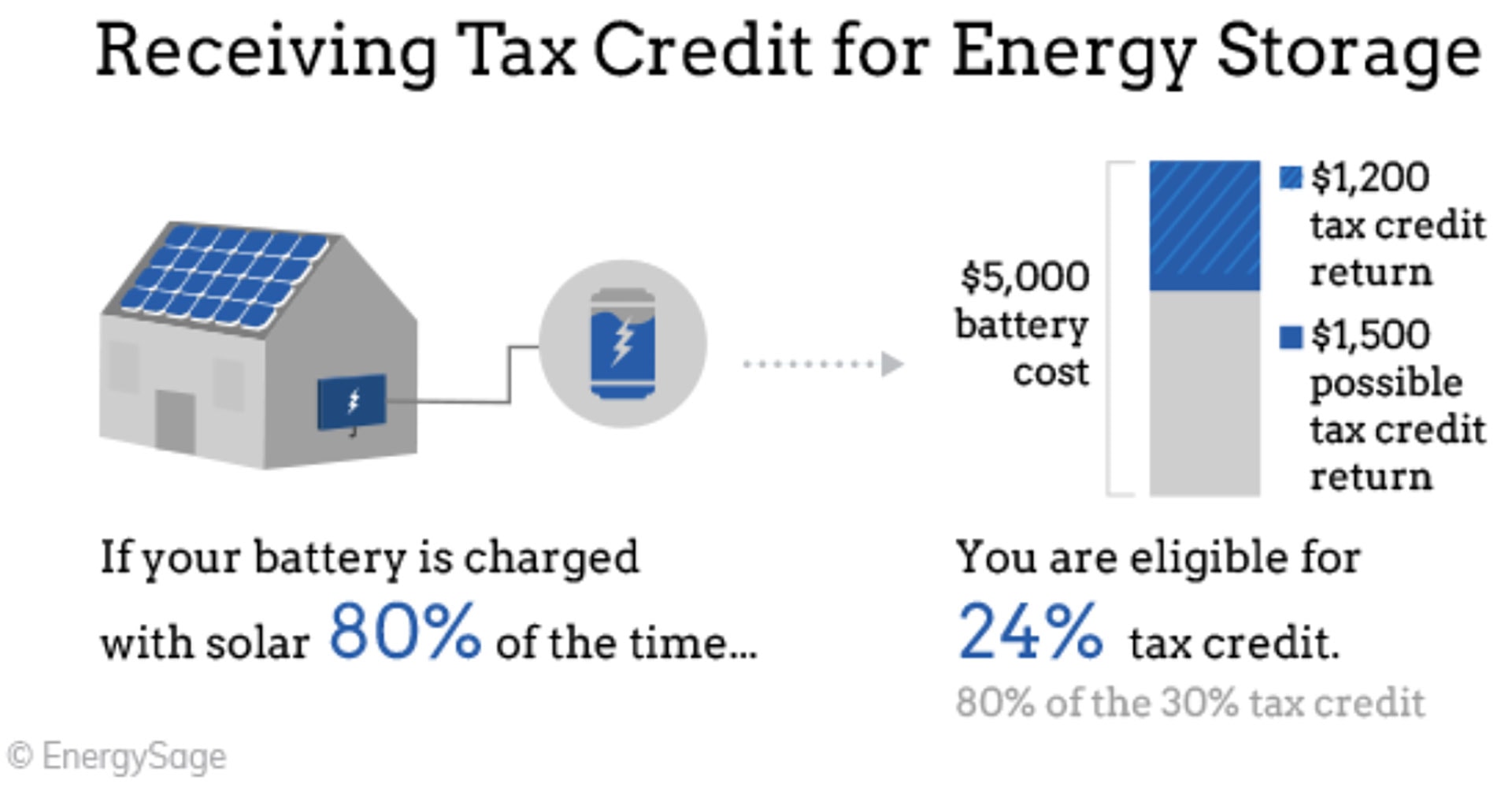

Solar power storage equipment for.

The Federal Solar Tax Credit Covers 30% Of The Following:

By kelsey misbrener | april 25, 2024.